May 30, 2020, marks another historic moment in American space ingenuity as astronauts resume their march into orbit aboard American technology. I wanted to know: how much does it cost to go to space in 2020?

I came to a total of $6.25 billion, all in.

The landmark achievement rode the back of a private commercial success in SpaceX’s Dragon Capsule on Falcon rockets.

In this post, I’ll break down the total expenditures SpaceX has incurred to reach this success. While the ISS rendezvous had direct costs much smaller than $6.25B, it’s the milestone achievement that Musk has aimed for since the start.

So, what did it take to get here?

Astronauts, Made in the USA

Before I dive into the details of how much it cost to go to space once again, I’d like to review a little of what SpaceX has accomplished with NASA.

Two NASA astronauts, Douglas Hurley and Robert Behnken, recently completed their 19-hour trip to dock with the International Space Station (ISS). They’re riding in the Crew Dragon Capsule—or Dragon 2—in orbit around Earth.

The astronauts named their specific vehicle Endeavour, harkening back to the Space Shuttle they’re all too familiar with. The moment the Falcon rocket took off from Florida with its two American passengers was a milestone achievement in the Dragon concept that SpaceX started in 2005.

Starting from Zero, Astronauts Reached Orbit Aboard Dragon in a Decade

The five year period after Dragon began saw significant development in Dragon’s underlying systems. Dragon’s first structural test flight was mid-2010, coinciding with the Falcon 9 rocket’s maiden voyage.

By December 2010, an operational test flight was launched with Dragon riding Falcon 9’s second flight.

In 2011, NASA began searching for private enterprise to continue missions to the ISS. NASA’s Space Shuttle program ceased in July 2011 with its last mission to the ISS for cargo delivery.

Not even two years after its initial operational test flight, Dragon saw its first goods transportation mission success as it docked with the ISS in 2012. Between then and now, Dragon has had many successful resupply missions to the ISS. Each time, the team behind Dragon learned a bit more about the capsule and how to further its mission to eventually carry humans to space again. All the while, this private commercial company fulfilled its resupply missions to the ISS, funding the human component too.

By early 2019, SpaceX began testing the Crew Dragon spacecraft, a variant of the Dragon 2 capsule. As opposed to the Cargo Dragon, the Crew Dragon capsule was designed to carry astronauts. This is the variant that would, today, carry both American astronauts into space. Technically, Endeavour is the fifth Crew Dragon, though the second to space. The first Crew Dragon to space made a similar mission to today’s landmark ISS docking, but without any crew aboard.

Paying Russia to Launch Americans

Since 2011, NASA has paid Russia to send American astronauts to the ISS.

How much does it cost to go to space? Between 2011 and 2020, it was $80 million per seat aboard Russian Soyuz capsules.

Through July of 2019, NASA spent $3.9 billion on transporting 70 American or partner astronauts to and from the ISS. That’s an average of $55.7 million across the 70 seats.

How much does it cost to go to space on Dragon with SpaceX? NASA estimates that the first six missions, including today’s, will cost $55 million per seat aboard the Crew Dragon. [1]

It’s very hard to know exactly what SpaceX has spent since its inception so that we might understand the cost to take our first two American astronauts to orbit since 2011. This is because SpaceX is a private company—we don’t have public data to analyze.

With that limitation in mind, let’s take a look at the total funding and earned contracts SpaceX has received.

How Much Does It Cost to Go to Space With SpaceX?

The closest we can get to understanding the total cost of sending astronauts Douglas Hurley and Robert Behnken to orbit in this mission is to total the known funding SpaceX has received for related work. This is from outside investment funding, personal funding from Musk, and delivered contracts from NASA.

There are some issues with this approach.

For one, SpaceX does much more than send astronauts to orbit.

The company also has contracts with the US Air Force, though some have not been completed, and others are more opaque.

SpaceX’s core business has been in sending humans and cargo to orbit or the ISS, so it makes sense to focus on outside funding to further that mission as well as known NASA contracts. While their recent delivery of a network of satellites designed to provide internet at a low cost caught a lot of attention, SpaceX’s primary revenue source is contracted deliveries to orbit and the ISS.

Let’s work through the funding to get an idea of how to answer: how much does it cost to go to space?

Elon Musk’s Personal Funding of SpaceX at its Inception

Most estimates put Elon Musk’s personal investment into founding SpaceX in 2002 at about $100 million. By 2008, SpaceX accepted $20 million in outside investment.

NASA was searching for private firms to be involved with human spaceflight in 2011. Funding awards were available to private companies that could help make that future a reality.

In the second round of commercial crew development funding awards, SpaceX earned $75 million to develop an integrated launch escape system for the Dragon capsule to improve human safety.

By 2012, estimates put Musk’s personal investment total at $100 million with another $100 million from outside investment. Estimates put the first decade of operational costs at about $1 billion. The difference, about $800 million, was from revenue on long-term launch and development contracts.

NASA’s Growth as a Source of Revenue for SpaceX

In August of 2012, SpaceX won an award worth $440 million from NASA. The award was intended to provide further funding for development and testing of the Dragon 2 spacecraft, with the Crew Dragon variant providing a method to take humans to the ISS once again.

By 2015, SpaceX raised additional outside funding in the amount of $1 billion. In 2017, another $350 million in outside funding was raised.

Later, SpaceX was awarded with another $2.6 billion worth of funding to certify the Dragon capsule for crewed flight by 2017.

Across 2019, SpaceX had multiple funding rounds with a total value of $1.33 billion. Early 2020 has already seen another $250 million in outside funding.

The Cost to Send SpaceX’s Dragon Capsule to Orbit with Two Astronauts

We can total Musk’s personal investment, outside funding, and NASA’s executed contracts to get an idea of how much money has gone into SpaceX over the last 18 years.

It’ll help us answer how much it costs to go to space in context of the entire SpaceX project from a scratch start to ISS docking.

This ignores some of the other, generally minor, funding sources SpaceX has received for more discrete work like USAF propulsion development. These are the funds that have been more focused on achieving the core mission of today’s flight, sending two American astronauts to the ISS.

To be clear: these funds have provided much more than to carry our first two astronauts on a private commercial vessel to the ISS.

They also represent the expenditures necessary to complete many resupply missions and progress towards future missions not yet completed. This is merely a snapshot in time of total funding SpaceX has received prior to a successful ISS docking mission with Dragon and crew.

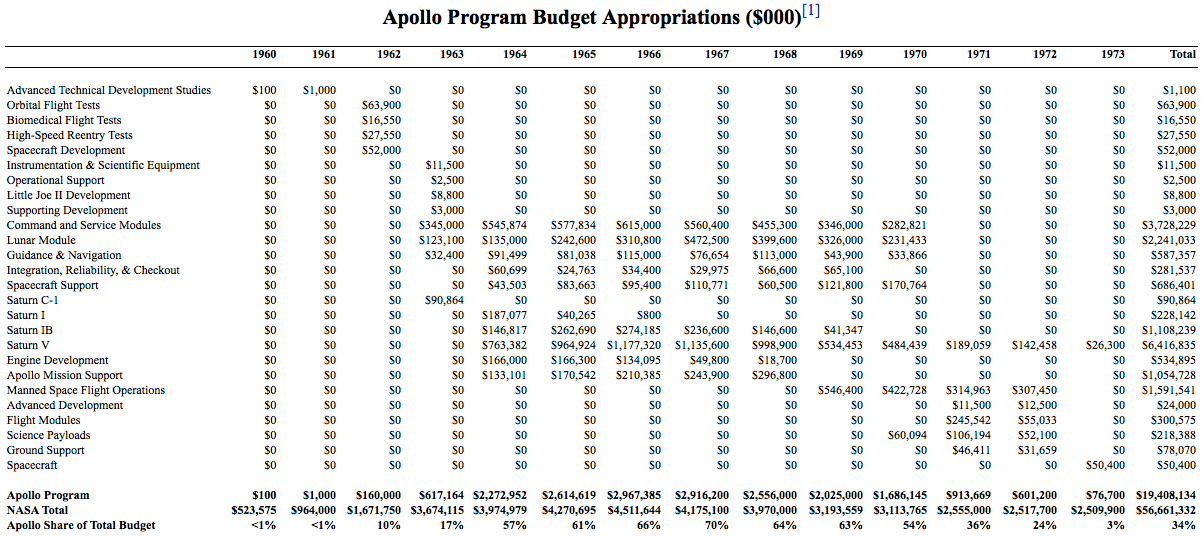

| Date | Amount (USD, Millions) | Source |

|---|---|---|

| 2002 | 100 | Elon Musk, Personal Funding |

| 2008 | 20 | Outside Funding |

| 2011 | 75 | NASA Award |

| 2012 | 80 | Outside Funding |

| 2012 | 440 | NASA Award |

| 2015 | 1000 | Outside Funding |

| 2017 | 350 | Outside Funding |

| 2017 | 2600 | NASA Award |

| 2019 | 1333 | Outside Funding |

| 2020 | 250 | Outside Funding |

| 6,248 | Total Funding |

SpaceX has most of the funds related to space logistics allotted to the company since its 2002 inception to reach today’s goal.

How much does it cost to go to space from scratch (and build an entire cargo network along the way)? $6.25 billion.

That may seem expensive if viewed as a bill to send these two astronauts, but remember that it’s the entire development and infrastructure it took to reach this point.

SpaceX will continue to provide crewed service and cargo service to the ISS, and much more, into the future.

The per-seat cost will amortize over time, drastically dropping with each successful mission.

NASA’s own estimates for the first six missions of Crew Dragon ring in at $55 million per seat.

This is the discrete cost NASA estimates for the Crew Dragon service. SpaceX has been able to obfuscate much of the development cost of Crew Dragon with its successful cargo missions as so much of the underlying systems are shared.

Space and Private Commercial Efficiency

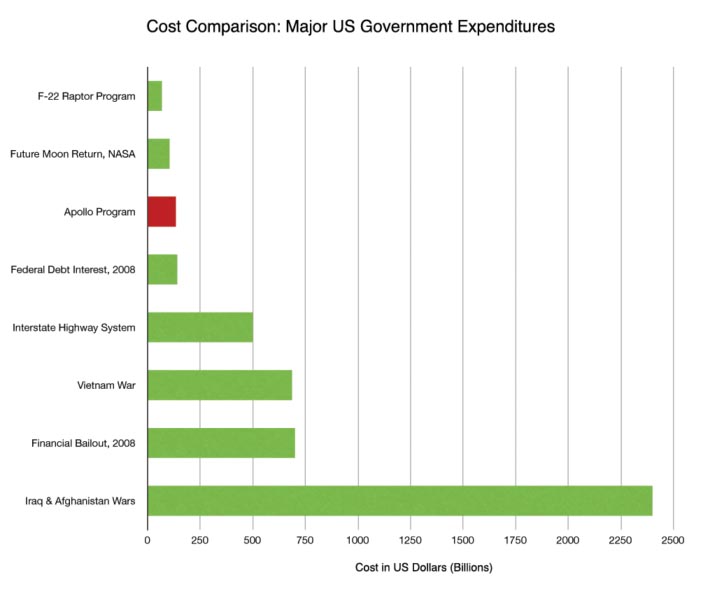

I wrote an article a few years ago with a central theme of identifying the Apollo Program cost. That article identified the total cost, inflation-adjusted to 2020, at about $194 billion. While that crushes our $6.25 billion SpaceX mission cost for today, that was also a much loftier goal: humans on the moon. But, what about the first Apollo mission with a successful trip to orbit?

While Freedom 7 was the first American mission successfully to space with Alan Shephard onboard, Apollo 7 was the first Apollo mission to space. This mission was in 1968 and NASA began appropriating funds for the Apollo Program in 1960. Through 1968, NASA appropriated $14,105,420 for the Apollo missions.

How much did it cost to go to space in 1968 for the US? About $108 billion in costs for the first Apollo mission successfully in orbit with humans aboard, inflation-adjusted to 2020. [4]

SpaceX’s mission goes far beyond the ISS and orbit, eventually onto Mars. It’s not unlike NASA’s grandiose mission beyond Apollo 7.

Congressional testimony in 2017 discussed funding related topics for SpaceX and NASA. The estimate for the total development cost of Falcon 1 and Falcon 9 rockets was $390 million. This estimate was independently verified. Prior to this development, NASA estimated it’d cost $4 billion to develop a rocket system like the Falcon 9 using their traditional methods. That’s approximately ten times SpaceX’s audited cost.

Will SpaceX be our Spacefaring Future?

As technological improvements continue to drive down the price of our phones, tablets, and computers, it does the same for rocket launch systems. SpaceX’s major innovations in rocket recovery have allowed it to drastically cut transportation costs. If estimates turn out to be accurate, NASA should reduce their per-seat cost for sending astronauts to the ISS by nearly half versus paying for Russian Soyuz seats.

There’s one other wild thing I noticed while watching today’s launch to orbit aboard SpaceX’s Dragon Capsule. The two astronauts only had one direct action button they could press: an emergency scrub button.

SpaceX has made launching humans to orbit an automated, algorithmic process controlled by computers. Let’s hope this “autopilot” to space creates safer launches and in turn, more efficient ones.

Douglas Hurley and Robert Behnken opened up new doors for humans to explore the unknown, and they’ve done so by being as separated from the process as possible.

FOOTNOTES

- NASA’s Office of Inspector General, 2019 report:

https://oig.nasa.gov/docs/IG-20-005.pdf - SpaceX, “Funding”:

via Wikipedia - Elon Musk’s Best Investments:

via Investopedia - NASA Budget Appropriations:

via NASA History - Imagery sourced from SpaceX

SpaceX creative commons Flickr